In the world of financial solutions, personal loan finance has become one of the most sought-after options for individuals aiming to fulfill various financial needs. Whether you are planning to consolidate debt, cover medical expenses, finance a dream vacation, or renovate your home, finance offers a flexible and convenient way to access funds without the hassle of collateral.

Personal loan refers to the borrowing of a specific amount of money from a financial institution that must be repaid over a set period with interest. This financial product is typically unsecured, which means it does not require the borrower to pledge any asset as collateral. The appeal of personal loan lies in its straightforward application process, flexible repayment terms, and usability for almost any personal financial requirement.

Understanding the workings of personal loan finance is crucial before committing to it. The mechanism behind personal loan involves several steps and important considerations that can significantly impact the borrowing experience and cost.

Key Takeaways

Personal loan finance is a versatile borrowing tool that provides unsecured loans for various personal expenses. It functions through a clear process involving application, approval, disbursal, and fixed monthly repayments. Interest rates and fees significantly influence the cost of personal loan , so understanding these is critical. While offering flexibility and convenience, personal loan must be approached cautiously with realistic repayment planning to avoid financial strain. Using personal loan wisely can support financial goals, improve credit scores, and ease short-term cash flow challenges.

The Essence of Personal Loan Finance

Personal loan finance is essentially a contract between a borrower and a lender, where the lender provides a lump sum amount of money based on the borrower’s creditworthiness, income, and repayment capacity. This contract stipulates the amount borrowed, the interest rate, the repayment schedule, and the consequences of default.

Unlike mortgage loans or auto loans, which are tied to specific assets, personal loan is more flexible because it is not restricted to a particular use. Borrowers can allocate the funds as they see fit, making it an attractive option for those who need financial assistance quickly and for a diverse range of needs.

Lenders offering personal loan include traditional banks, credit unions, online lenders, and peer-to-peer lending platforms. Each type of lender may have slightly different terms, interest rates, and eligibility criteria.

How Personal Loan Finance Works

When you seek personal loan , the first step involves evaluating your financial situation and deciding how much money you need to borrow. It is essential to borrow only the amount that you can realistically repay over time, considering your monthly income and expenses.

The application for personal loan requires providing personal information and financial documentation. This process helps lenders assess the risk of lending money to you. Your credit score plays a pivotal role here as it gives lenders insight into your history of repaying debts. Higher credit scores often translate to better terms in personal loan , such as lower interest rates.

Once your application for personal loan is submitted, the lender reviews your creditworthiness, income, employment status, and debt-to-income ratio. If approved, you will receive an offer detailing the loan amount, interest rate, repayment period, and monthly installment amount. These terms define how your personal loan will proceed.

Upon acceptance of the loan offer, the lender disburses the funds, often directly into your bank account. You begin repayment through equated monthly installments (EMIs), which cover both principal and interest, over the agreed period.

Interest Rates and Fees in Personal Loan Finance

One of the critical aspects of personal loan is understanding how interest rates are applied. Interest on personal loan finance can be fixed or variable. Fixed interest rates remain constant throughout the loan tenure, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, which can lead to changes in your monthly EMI.

Personal loan also involves additional fees such as processing fees, late payment penalties, and prepayment charges. These costs can affect the total amount you repay, so it is vital to read the terms carefully before signing the agreement.

Types of Personal Loan Finance

When exploring personal loan finance, it’s important to recognize that not all personal loans are the same. Different types of personal loan exist to cater to varying borrower requirements, risk profiles, and financial circumstances. Understanding these types helps you make an informed decision about which loan product best fits your financial goals.

Secured Personal Loan Finance

Secured personal loan is a type of loan where the borrower offers collateral as security against the loan amount. The collateral can be an asset such as real estate property, a vehicle, fixed deposits, or other valuables.

Features of Secured Personal Loan Finance

- Collateral Requirement: The borrower must pledge an asset to obtain the loan. This reduces the lender’s risk.

- Lower Interest Rates: Since the loan is backed by collateral, lenders often charge lower interest rates compared to unsecured loans.

- Higher Loan Amounts: The presence of collateral allows lenders to offer larger loan amounts.

- Longer Tenure Options: Secured loans generally offer more flexible and extended repayment periods.

- Risk of Asset Loss: If the borrower defaults, the lender can seize the collateral to recover the outstanding loan balance.

Suitable For

Individuals who own valuable assets and want to borrow larger sums at lower interest rates often prefer secured personal loan . It is ideal for major expenses like home renovations, large medical bills, or education financing.

Unsecured Personal Loan Finance

Unsecured personal loan finance does not require the borrower to provide collateral. Approval depends solely on the borrower’s creditworthiness, income, and ability to repay.

Features of Unsecured Personal Loan Finance

- No Collateral Needed: The absence of collateral makes the loan accessible but riskier for lenders.

- Higher Interest Rates: Because of the higher risk, lenders charge higher interest rates than secured loans.

- Quick Approval and Disbursal: The application process is faster and simpler due to fewer requirements.

- Lower Loan Amounts: Typically, loan amounts are smaller compared to secured loans.

- Strict Eligibility Criteria: Lenders assess credit scores rigorously; poor credit can lead to rejection or higher rates.

Suitable For

Unsecured personal loan is suitable for borrowers who need quick access to funds without risking assets. It’s often used for smaller expenses like travel, emergency funds, or consolidating credit card debt.

Fixed-Rate Personal Loan Finance

This type of personal loan finance offers a fixed interest rate for the entire tenure of the loan.

Features of Fixed-Rate Personal Loan Finance

- Predictable Payments: EMIs remain constant, making budgeting easier.

- Protection Against Interest Fluctuations: Borrowers are insulated from market interest rate changes.

- Generally Higher Initial Rates: Fixed rates can be slightly higher at the start compared to variable rates.

Suitable For

Borrowers who prefer financial stability and want to avoid surprises in their monthly payments choose fixed-rate personal loan . It is ideal for disciplined financial planning.

Variable-Rate Personal Loan Finance

Variable-rate personal loan features an interest rate that fluctuates based on market conditions or benchmark rates set by central banks.

Features of Variable-Rate Personal Loan Finance

- Interest Rate Changes: EMIs can increase or decrease depending on market interest trends.

- Potential for Lower Rates: If rates fall, borrowers benefit from reduced payments.

- Uncertainty in Payments: The unpredictability of EMIs can make budgeting challenging.

Suitable For

This type suits borrowers willing to take some risk for the possibility of paying lower interest over time. It is often preferred in a stable or declining interest rate environment.

Debt Consolidation Loans

Debt consolidation is a specialized form of personal loan where multiple high-interest debts are combined into a single loan with one monthly payment.

Features of Debt Consolidation Loans

- Simplified Repayment: Instead of managing multiple debts, borrowers have one loan to repay.

- Potential Lower Interest Rates: Consolidation loans may offer lower rates than credit cards or payday loans.

- Improves Credit Score: Timely repayments can positively impact credit history.

Suitable For

Individuals struggling with multiple debts and seeking a manageable repayment plan often opt for debt consolidation personal loan .

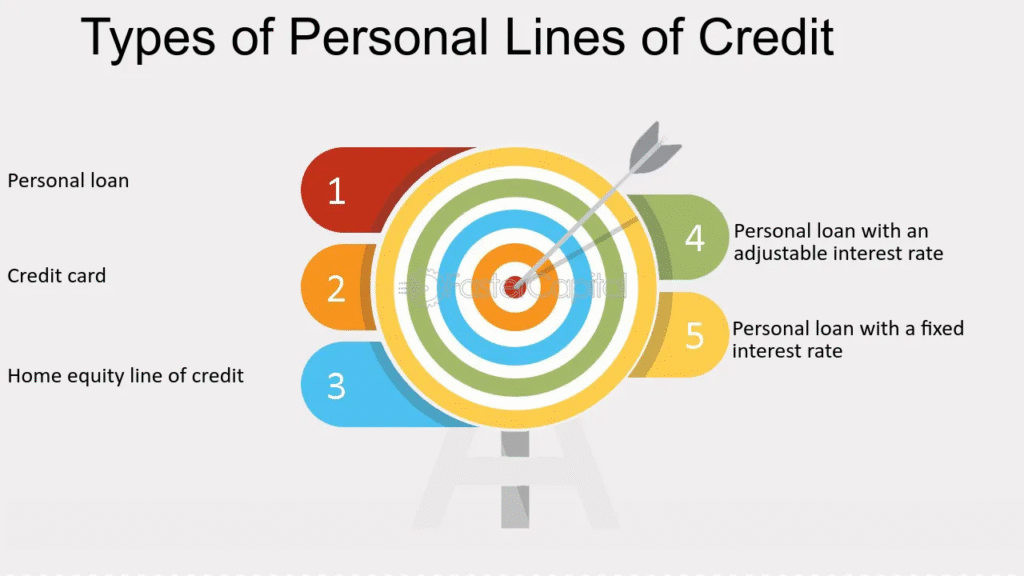

Personal Lines of Credit

Though not strictly a personal loan, a personal line of credit is a revolving credit facility that provides flexible access to funds up to a specified limit.

Features of Personal Lines of Credit

- Flexible Borrowing: Borrowers can draw funds as needed, repay, and borrow again.

- Interest on Amount Used: Interest accrues only on the borrowed amount, not the full limit.

- Variable Interest Rates: Rates typically fluctuate based on market conditions.

Suitable For

This option is ideal for those with ongoing or unpredictable cash flow needs, such as small business owners or freelancers.

Payday Loans (Short-Term Personal Loans)

Payday loans are short-term, high-interest personal loan options designed to cover urgent, small cash needs until the next paycheck.

Features of Payday Loans

- Quick and Easy Access: Minimal documentation and rapid disbursal.

- Very High Interest Rates: Costs can be exorbitant compared to other personal loan .

- Short Tenure: Usually due within two to four weeks.

Suitable For

Use payday loans cautiously for emergencies only, as the high costs can lead to debt cycles.

Benefits of Personal Loan Finance

| Benefit | Description |

|---|---|

| Flexible Use of Funds | Can be used for various purposes like medical bills, weddings, education, or debt consolidation without restriction. |

| Quick Access to Funds | Fast approval and disbursal process, especially with online lenders—often within 24–48 hours. |

| No Collateral Required | Most personal loans are unsecured, meaning you don’t need to risk assets like your home or car. |

| Fixed Repayment Schedule | Regular monthly EMIs provide predictability and easier budgeting. |

| Improves Credit Score | Timely repayment contributes positively to your credit history and score. |

Personal loan has become an increasingly popular option for individuals seeking financial support for various needs. Its appeal stems from a range of benefits that make it accessible, flexible, and suitable for many different financial situations. Below is an in-depth look at the key advantages that personal loan offers.

Flexibility of Use

One of the most significant benefits of personal loan finance is its unmatched flexibility. Unlike many other types of loans that are earmarked for specific purposes—such as mortgages for home purchases or auto loans for vehicles—personal loan is typically unrestricted in how the funds can be used.

Whether you need to cover medical expenses, consolidate multiple debts, fund a wedding, pay for education, or finance home improvements, personal loan finance allows you to allocate the borrowed money as you see fit. This flexibility makes personal loan finance an ideal choice for managing a wide variety of financial needs without the need to explain or justify your spending to the lender.

Quick and Easy Access to Funds

Personal loan finance is often characterized by a streamlined and efficient application process, especially with the rise of digital lending platforms. Many lenders offer online applications, with quick approvals and rapid disbursal of funds—sometimes within 24 to 48 hours.

This speed of access is invaluable in times of financial emergencies or when timely capital is needed. The ability to quickly obtain personal loan finance can help borrowers avoid costly alternatives such as payday loans or high-interest credit card borrowing.

Fixed Repayment Schedule

With personal loan finance, borrowers generally benefit from a fixed repayment schedule consisting of equated monthly installments (EMIs). Each EMI includes both principal and interest, which means you have a clear and predictable payment plan throughout the tenure of the loan.

This structured repayment approach helps in budgeting personal finances, as you know exactly how much you owe every month and when your loan will be fully repaid. It reduces uncertainty compared to revolving credit facilities where minimum payments can fluctuate.

No Collateral Required (For Unsecured Loans)

Many personal loan finance products are unsecured, meaning that you do not need to pledge an asset such as a home, vehicle, or savings as collateral to qualify. This lowers the barrier for borrowing, especially for those who may not own valuable assets.

Because personal loan finance is unsecured, there is less risk of losing property in case of financial difficulty. However, this also means lenders rely heavily on credit history and income verification to determine eligibility and interest rates.

Helps Improve Credit Score

When personal loan finance is managed responsibly, it can contribute positively to your credit history and score. Timely repayment of EMIs shows lenders that you are a reliable borrower, which can improve your creditworthiness.

A good credit score opens doors to better financial products in the future, including mortgages, credit cards, and even lower-interest personal loan finance options. Conversely, poor management of personal loan finance, such as missed payments, can harm your credit score, so it’s crucial to remain disciplined.

Debt Consolidation

One of the most practical uses of personal loan finance is for debt consolidation. If you have multiple high-interest debts—like credit card balances, store cards, or payday loans—personal loan finance can be used to combine these debts into a single loan with a potentially lower interest rate.

This consolidation simplifies debt management by reducing the number of payments you make each month. It also often lowers the total interest you pay, saving money and reducing financial stress. Debt consolidation through personal loan finance can be a powerful tool for regaining control over your finances.

Risks and Considerations in Personal Loan Finance

Despite the benefits, personal loan finance carries risks that must be managed wisely. High-interest rates on unsecured personal loan finance can lead to substantial repayment amounts, increasing the borrower’s financial burden. Missing EMIs can negatively affect credit scores and may incur penalties.

Another consideration in personal loan finance is the temptation to borrow more than necessary. Excessive borrowing can lead to unmanageable debt levels and financial stress.

Always assess your repayment capacity before availing personal loan finance. Understanding the total cost of the loan, including interest and fees, is crucial to making an informed decision.

How to Apply for Personal Loan Finance

Applying for personal loan finance has become more accessible due to digital advancements. The process usually involves:

- Online Application: Filling out the loan form with personal and financial details.

- Document Submission: Providing identity proof, income proof, and bank statements.

- Loan Processing: The lender evaluates the application, runs credit checks, and verifies documents.

- Approval and Disbursal: Once approved, the funds are transferred, often within a few days.

To improve chances of approval in personal loan finance, maintaining a good credit score, steady income, and low existing debt is essential.

Managing Personal Loan Finance Responsibly

To make the most of personal loan finance, it is vital to maintain discipline in repayments and avoid defaults. Setting up automatic payments can help ensure timely EMIs. Also, staying aware of your loan balance and tenure helps plan future finances effectively.

Refinancing or prepaying personal loan finance is possible with some lenders, allowing you to reduce the interest burden if your financial situation improves.

Also Read: How Do You Qualify for a Business Loan from a Bank?

Conclusion

Personal loan finance offers an effective and flexible solution for a wide array of financial needs, providing quick access to funds without the burden of collateral. Its straightforward application process and fixed repayment schedule make it an attractive choice for many. However, like any financial product, personal loan finance requires careful consideration of interest rates, fees, and repayment capacity to avoid potential pitfalls.

When used responsibly, personal loan finance can improve your financial well-being by managing emergencies, consolidating debts, or funding important life events. Always ensure to compare offers from multiple lenders and understand the terms thoroughly before committing to personal loan finance.

FAQs

What is the typical interest rate for personal loan finance?

Interest rates vary widely based on credit score, lender policies, and whether the loan is secured or unsecured, generally ranging from moderate to high.

Can personal loan finance be used for any purpose?

Yes, one of the main advantages of personal loan finance is its flexibility. Funds can be used for weddings, travel, education, medical emergencies, debt consolidation, or other personal needs.

How does my credit score affect my personal loan finance?

A higher credit score generally results in better interest rates and loan terms in personal loan finance, as it indicates reliability in repayment.

What documents are required to apply for personal loan finance?

Typically, proof of identity, address, income, employment, and bank statements are required when applying for personal loan finance.

Is collateral required for personal loan finance?

Most personal loan finance options are unsecured and do not require collateral. However, secured personal loan finance options do exist.

Can I repay my personal loan finance early?

Many lenders allow early repayment or part-prepayment, sometimes with a penalty fee. Early repayment can save on interest costs.

What happens if I miss an EMI on my personal loan finance?

Missing an EMI can lead to late payment fees, damage your credit score, and may eventually lead to default consequences as per the loan agreement.