In today’s competitive economic landscape, businesses—whether new startups or long-established enterprises—often need access to funding. Whether it’s for expanding operations, purchasing inventory, acquiring equipment, or bridging gaps in cash flow, financing can make or break a company’s momentum. Among the many financing options available, one of the most accessible and potentially advantageous is a Secured Business Loan.

A Secured Business Loan is more than just a financial tool; it’s a strategic resource that offers flexibility, scalability, and relatively lower interest rates for business owners willing to pledge assets. Understanding how this type of loan works, its benefits, and its potential risks is crucial for any business decision-maker aiming to ensure sustainable growth.

Let’s explore in-depth what a Secured Business Loan is, how it functions, who it’s best suited for, and how to leverage it for your business success.

Key Takeaways

- A Secured Business Loan involves collateral, providing the lender with security in case of default.

- Businesses benefit from lower interest rates, larger loan amounts, and extended repayment periods.

- Common types of collateral include real estate, equipment, inventory, and accounts receivable.

- These loans are ideal for businesses with significant assets, expansion goals, or limited credit history.

- Risks include potential loss of collateral, complex approval processes, and asset depreciation.

- A Secured Business Loan should be aligned with clear financial goals and repayment capabilities.

Understanding the Basics of a Secured Business Loan

This form of loan is fundamentally different from an unsecured business loan, which does not require collateral but typically comes with higher interest rates and more stringent eligibility requirements.

Because the Secured Business Loan is backed by collateral, it tends to be easier to qualify for, particularly for businesses with a limited credit history or slightly lower credit scores. Lenders view these loans as less risky, which translates into more favorable terms for the borrower.

A Secured Business Loan is one of the oldest and most widely used forms of financing in the business world. It forms the foundation for many commercial lending structures and serves as a reliable way for businesses to access capital while minimizing risk for lenders. The concept is simple but involves several critical components that every business owner should fully understand before applying.

What Is a Secured Business Loan?

A Secured Business Loan is a loan backed by an asset or collateral. The borrower pledges this asset to the lender, who gains a legal right to claim ownership of it if the loan is not repaid as agreed. The collateral serves as a form of protection for the lender, ensuring that the loan can be repaid through the sale of the asset if necessary.

This type of loan can be used for a wide range of business purposes, including purchasing equipment, funding expansion, maintaining cash flow, refinancing debt, or acquiring real estate. Because the lender has the security of collateral, they are generally more willing to offer favorable loan terms—including lower interest rates, higher borrowing limits, and longer repayment schedules—compared to unsecured loans.

Why Lenders Prefer Secured Loans

Lenders are in the business of risk management. When a loan is unsecured, the only assurance the lender has is the borrower’s creditworthiness. This creates a higher risk of loss. A Secured Business Loan, by contrast, reduces the lender’s exposure. If the business fails to repay the loan, the lender can seize the asset and sell it to recover their money.

This decreased risk allows lenders to be more flexible and competitive with the terms they offer. They can approve loans more quickly and lend to businesses that might not qualify for unsecured credit.

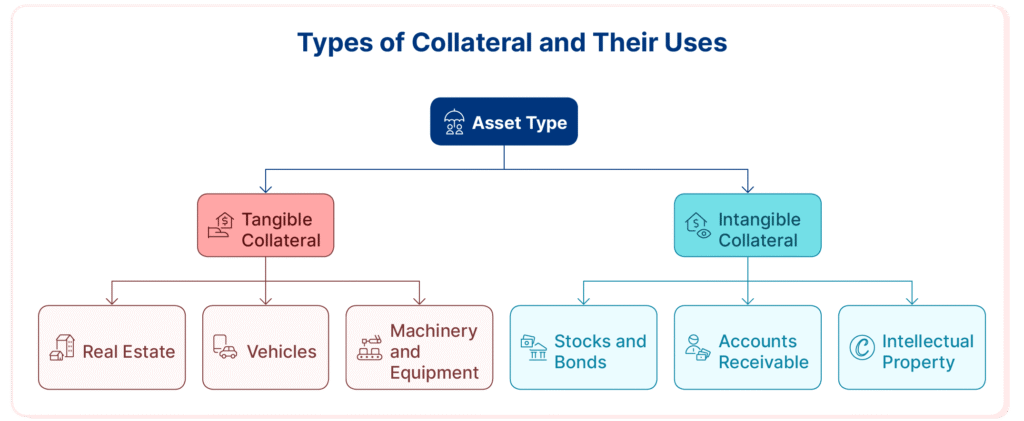

Common Assets Used as Collateral

One of the defining elements of a Secured Business Loan is the collateral itself. A wide variety of assets can serve as collateral, depending on the lender’s policies and the nature of the business. These include:

- Real Estate: Commercial property, land, or even residential property owned by the business or its owners.

- Equipment: Machinery, vehicles, or other fixed assets used in business operations.

- Inventory: Retailers and wholesalers may pledge their current stock of goods.

- Accounts Receivable: Outstanding invoices due to the business, which can be pledged as future income.

- Savings or Certificates of Deposit: Cash collateral can be the most straightforward form, offering immediate liquidity for the lender.

- Personal Assets: In some cases, especially for small or new businesses, personal property such as homes, vehicles, or investments may be used.

Loan-to-Value (LTV) Ratio

The Loan-to-Value Ratio (LTV) is a critical factor in determining how much money a business can borrow with a Secured Business Loan. This ratio compares the loan amount to the appraised value of the collateral. For example, if a business pledges equipment worth $100,000 and the lender offers a loan at a 70% LTV, the maximum loan amount would be $70,000.

Lenders prefer lower LTV ratios because it provides a buffer in case the value of the asset declines. High LTV ratios increase risk, so they often come with stricter terms or additional requirements.

Legal Rights and Lien Placement

When a lender approves a Secured Business Loan, they usually place a lien on the collateral. A lien is a legal claim or right against the asset, which means the borrower cannot sell or transfer ownership of the asset without the lender’s consent. The lien remains in place until the loan is fully repaid.

In the event of a default, the lender has the right to take possession of the asset and sell it to recover the unpaid loan balance. Depending on the jurisdiction, the process for enforcing a lien can vary, but it typically requires legal procedures such as repossession or foreclosure.

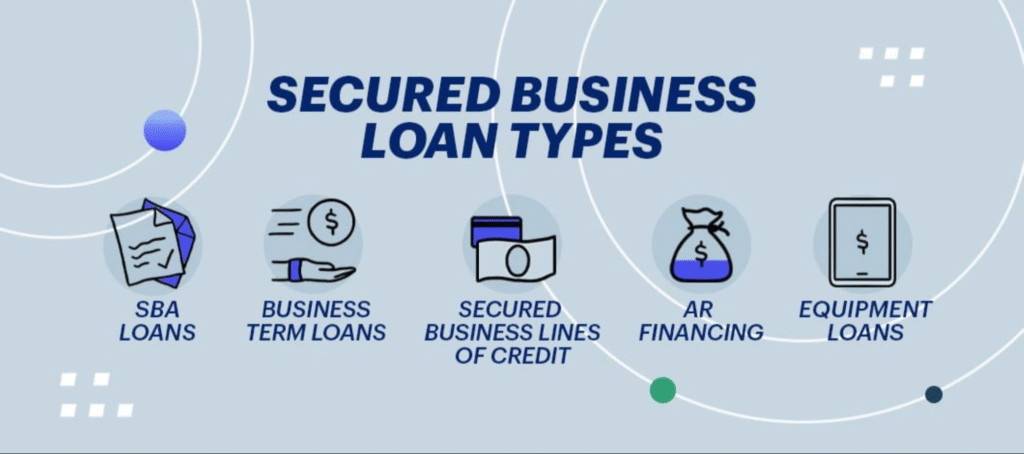

Types of Secured Business Loans

There are several types of Secured Business Loans, each designed to meet different needs:

- Term Loans: Fixed loan amounts repaid over a set schedule. These are ideal for one-time capital investments.

- Lines of Credit: Flexible funding where a maximum amount is approved, and the business can draw and repay repeatedly.

- Invoice Financing: Allows businesses to borrow against outstanding invoices.

- Equipment Financing: Specifically designed for purchasing equipment, with the equipment itself serving as collateral.

- Commercial Real Estate Loans: Used to purchase or refinance business property.

Each of these loan types can be secured by a variety of assets, and the structure of the loan depends on the borrower’s needs and the lender’s requirements.

Credit and Financial Requirements

While the presence of collateral makes it easier to obtain financing, lenders still consider other factors when evaluating an application for a Secured Business Loan:

- Business Credit Score: A history of timely payments and responsible credit use helps build lender confidence.

- Personal Credit Score: Particularly for small businesses, the owner’s credit score often influences loan approval.

- Business Plan and Cash Flow: Lenders will want to understand how the loan will be used and how the business plans to repay it.

- Debt-to-Income Ratio: This ratio indicates whether the business can manage additional debt responsibly.

Having strong financial documentation and a clear use-case for the loan increases the likelihood of approval and may help secure more favorable terms.

Who Should Consider a Secured Business Loan?

Not every business needs or should use a Secured Business Loan. However, it is an excellent option for companies that:

- Own valuable assets they are comfortable using as collateral.

- Need a large amount of capital at favorable interest rates.

- Have been turned down for unsecured loans due to limited credit history or weak financials.

- Are looking to build or rebuild business credit through regular loan repayments.

- Are in industries that involve high startup costs or cyclical cash flow.

Startups, construction firms, manufacturers, and wholesale retailers are examples of businesses that frequently use secured loans as part of their financial strategy.

Risk vs. Reward

Like any financial product, a Secured Business Loan comes with both opportunities and risks. The benefits of lower interest rates, larger loan amounts, and flexible terms must be weighed against the risk of losing critical business assets if the loan cannot be repaid.

Business owners must carefully assess their financial position, business outlook, and repayment ability before committing. Poor planning or unexpected downturns could result in serious consequences, including loss of property, damaged credit, or even legal action.

How a Secured Business Loan Works in Practice

When applying for a Secured Business Loan, a business must first identify which asset(s) it is willing to offer as collateral. The value and type of the asset will significantly influence the loan amount, interest rate, and repayment terms.

The process generally begins with the borrower approaching a bank, credit union, or alternative lender. The borrower provides documentation that includes business financials, credit history, and information about the collateral being offered. The lender then appraises the asset and determines its market value.

Once the loan is approved, the lender issues the funds. These funds can typically be used for a wide variety of business purposes, including expansion, working capital, or capital investments.

During the life of the loan, the borrower makes regular payments—usually monthly—that consist of principal and interest. If the borrower defaults on the loan, the lender has the legal right to seize the collateral and sell it to recover the outstanding debt.

This structure makes a Secured Business Loan an attractive option for both parties: the borrower gets needed capital at lower interest rates, and the lender has a layer of protection against default risk.

Common Types of Collateral Used in Secured Business Loans

Collateral is the defining feature of a Secured Business Loan. The nature of the collateral depends largely on the nature of the business and the loan purpose. Here are the most common types of collateral accepted by lenders:

Real Estate

Commercial or even personal real estate is often used as collateral due to its high value. Lenders prefer real estate because it’s a tangible, relatively stable asset.

Equipment and Machinery

Businesses that rely heavily on machinery, such as construction or manufacturing companies, often use equipment as collateral. The equipment itself is typically the item being financed.

Inventory

Retailers or wholesalers may use their stock as collateral. However, since inventory value can fluctuate, lenders may be conservative with how much they lend against it.

Accounts Receivable

For businesses with a steady stream of invoices, those receivables can be used as collateral. This form of asset-backed financing is commonly known as invoice financing or factoring.

Vehicles

Business-owned vehicles can also serve as collateral, especially for transportation or logistics companies.

Savings or Investment Accounts

Some lenders allow borrowers to use certificates of deposit, savings accounts, or even investment portfolios as collateral.

Each of these options presents unique risks and advantages. The suitability of a Secured Business Loan often hinges on the value, liquidity, and depreciation rate of the collateral offered.

Advantages of Secured Business Loans

A Secured Business Loan provides numerous benefits to businesses, particularly those in need of significant funding or more favorable lending terms.

Lower Interest Rates

Since the lender has the added security of an asset, they often offer lower interest rates compared to unsecured loans. This reduction in borrowing costs can make a huge difference for long-term capital projects.

Higher Borrowing Limits

Because collateral reduces the lender’s risk, they are typically more willing to lend larger sums of money. This is particularly useful for capital-intensive businesses.

Longer Repayment Terms

A Secured Business Loan generally comes with longer repayment periods, which can ease the burden of monthly payments and improve cash flow management.

Easier Qualification

For businesses with poor or limited credit histories, securing a loan may be difficult. Offering collateral increases the chances of approval even with a sub-optimal credit score.

Improved Business Credit

Making regular, on-time payments on a Secured Business Loan can help businesses improve their credit profile, which opens the door to even more favorable financing options in the future.

Disadvantages and Risks of Secured Business Loans

| Advantages of Secured Business Loans | Disadvantages of Secured Business Loans |

|---|---|

| Lower Interest Rates – Because lenders face less risk, they offer lower rates. | Risk of Asset Loss – If the borrower defaults, the lender can seize the collateral. |

| Higher Borrowing Limits – Businesses can access more capital. | Asset Restriction – Collateral cannot be sold or used for other purposes. |

| Easier Approval – Collateral reduces reliance on credit score or business age. | Time-Consuming Process – Valuation and documentation can delay approval. |

| Longer Repayment Terms – Repayment is often stretched over longer periods. | Depreciation Risk – Collateral may lose value over time, affecting loan viability. |

| Flexible Use of Funds – Can be used for expansion, inventory, equipment, etc. | Additional Costs – Legal, appraisal, and insurance fees may be required. |

| Improves Credit History – Timely repayment strengthens business credit score. | Personal Guarantee Often Required – Especially for small or new businesses. |

| Better for Startups with Assets – Startups can qualify if they offer collateral. | Overleveraging Risk – Large amounts may tempt businesses to borrow more than needed. |

While a Secured Business Loan offers many advantages, it is not without risk. Understanding these drawbacks is vital before committing.

Asset Risk

The most obvious risk is the potential loss of the asset used as collateral. If the business cannot repay the loan, the lender has the legal right to seize and sell the collateral.

Complex Application Process

Secured loans often require detailed documentation and thorough appraisals of collateral, which can make the process time-consuming and bureaucratic.

Depreciation Issues

Some types of collateral, like vehicles or certain equipment, lose value over time. This depreciation can affect loan terms or lead to additional requirements like more frequent reappraisals.

Limited Use of Assets

Assets used as collateral may be tied up during the life of the loan, meaning they cannot be sold, refinanced, or otherwise leveraged for other business needs.

Potential for Over-Borrowing

Because Secured Business Loans offer larger amounts, there is a temptation to borrow more than is needed, which can lead to unnecessary debt burdens.

When Should a Business Consider a Secured Business Loan?

A Secured Business Loan is not always the right choice for every business. However, it may be particularly suitable under the following conditions:

- When seeking to finance large purchases like real estate or heavy machinery.

- When needing to consolidate higher-interest debt into a more manageable and affordable repayment structure.

- When facing cash flow gaps but holding valuable assets.

- When starting a business and traditional unsecured loans are out of reach.

- When seeking to establish or improve business creditworthiness over time.

Also Read: How Do You Qualify for a Business Loan from a Bank?

Conclusion

A Secured Business Loan offers a compelling financial solution for businesses seeking substantial funding with favorable terms. By leveraging existing assets, businesses can access capital for growth, operations, or recovery while often enjoying lower interest rates and longer repayment timelines.

However, with opportunity comes responsibility. The risk of losing collateral means that businesses must approach these loans with careful planning and a clear strategy for repayment. Used wisely, a Secured Business Loan can be a stepping stone to greater success and financial stability.

FAQs

What qualifies as acceptable collateral for a Secured Business Loan?

Acceptable collateral includes commercial real estate, business equipment, inventory, accounts receivable, and vehicles. Some lenders may also accept personal assets.

Can I use a personal asset to secure a business loan?

Yes, many small business owners use personal assets, especially when business assets are insufficient. However, this increases personal risk.

How much can I borrow with a Secured Business Loan?

The amount depends on the value of the collateral and the lender’s loan-to-value ratio, which usually ranges from 50% to 80%.

Is a personal guarantee required for a Secured Business Loan?

Often, yes. Many lenders require a personal guarantee in addition to collateral, especially for small businesses.

How long does it take to get a Secured Business Loan?

Because of the asset appraisal and documentation involved, it may take from a few days to several weeks.

Will a Secured Business Loan affect my credit score?

Yes, like any credit product, timely payments can improve your score, while defaults can negatively impact it.

Can I refinance a Secured Business Loan later?

Yes, businesses can refinance to obtain better terms, lower interest rates, or access additional capital.