Auto loans make it possible for millions of people to purchase vehicles without paying the full cost upfront. However, before a lender agrees to finance your vehicle, you must meet certain criteria that demonstrate your ability to repay the loan. This process, known as auto loan approval, involves evaluating a range of financial, credit-related, and personal factors to determine your eligibility.

Understanding the requirements for auto loan approval is essential whether you’re buying a new car, a used vehicle, or even refinancing an existing loan. While different lenders may have slightly varied criteria, the fundamental principles remain the same. Being well-informed and prepared can significantly improve your chances of securing favorable loan terms and interest rates.

Key Takeaways

- Auto loan approval depends heavily on credit score, income stability, and debt-to-income ratio.

- Providing a down payment can improve your chances and lower interest rates.

- Employment verification and detailed financial documentation are essential parts of the process.

- Including a co-signer or offering collateral can help if your credit is less than perfect.

- Pre-approval offers flexibility and better leverage when negotiating with dealerships.

Types of Lenders and Their Auto Loan Approval Requirements

When applying for an auto loan, the type of lender you choose can influence the requirements and your overall experience. Each lender has its own set of guidelines and approval thresholds. Understanding these differences can help you better prepare for auto loan approval and choose the lender best suited to your situation.

Banks and Credit Unions

Traditional banks often have stricter criteria for auto loan approval, particularly concerning credit scores and income. However, they may offer competitive interest rates, especially to existing customers. Credit unions, in contrast, tend to be more flexible and may work more personally with borrowers to help them achieve auto loan approval.

Online Lenders

Online auto loan providers offer convenience and quick application processes. Many specialize in loans for borrowers with fair or poor credit, making auto loan approval more accessible. These platforms often allow you to compare multiple offers, improving your chances of finding a loan that suits your needs.

Dealership Financing

Many car dealerships offer in-house financing or partner with lenders to provide loans directly. While convenient, dealership financing can come with higher interest rates or less favorable terms. However, dealerships may approve auto loans more easily for buyers who are on the credit margin, often using promotional deals or manufacturer incentives to facilitate auto loan approval.

Subprime Lenders

For borrowers with poor credit histories, subprime lenders offer specialized services. They typically approve auto loans with higher interest rates and shorter repayment terms. While the path to auto loan approval may be easier, borrowers should be cautious and understand the full cost of borrowing.

How Interest Rates Affect Auto Loan Approval and Total Cost

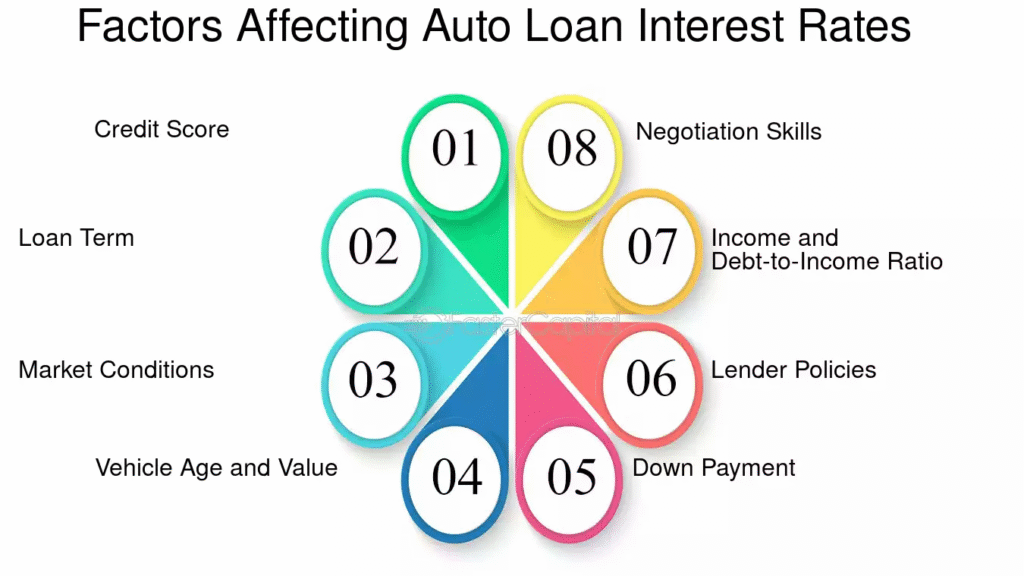

Interest rates play a vital role not only in your monthly payments but also in the lender’s decision-making process during auto loan approval. A borrower with a high credit score is often rewarded with a lower interest rate, which significantly reduces the overall cost of the loan.

Lenders consider interest rates as compensation for the risk they assume by lending money. During the auto loan approval process, they evaluate your financial risk based on factors like your credit score, loan term, and down payment. Lower perceived risk results in lower rates and faster auto loan approval.

Auto loan interest rates can also be influenced by:

- Loan duration (shorter terms usually come with lower rates)

- New vs. used vehicle (new cars often qualify for lower rates)

- Lender’s internal criteria

- Market interest rates set by central banks

Before applying, use an auto loan calculator to estimate your monthly payments and total interest over time. This can help you determine whether your financial profile aligns with realistic auto loan approval conditions.

Mistakes to Avoid When Applying for Auto Loan Approval

Avoiding common mistakes can greatly increase your chances of getting approved for an auto loan on favorable terms. Many applicants unknowingly sabotage their own auto loan approval efforts by making avoidable errors. Here are some key mistakes to watch out for:

Not Checking Your Credit Score in Advance

One of the most common mistakes is applying without knowing your current credit status. Checking your credit score beforehand helps you identify areas for improvement and prepare supporting documentation.

Applying for Too Many Loans at Once

Each application for an auto loan results in a hard inquiry on your credit report. Multiple inquiries in a short period can lower your credit score and make lenders cautious. Shop around, but do so within a short timeframe (typically 14 to 30 days) to avoid damaging your credit during the auto loan approval process.

Ignoring Pre-Approval Options

Skipping pre-approval can lead to less favorable terms and reduced negotiating power. Pre-approval gives you a clear understanding of what you can afford and shows dealers you’re a serious buyer.

Choosing a Vehicle Outside Your Budget

Requesting a loan amount that’s disproportionate to your income and credit standing may result in denial. Lenders may view it as overextending yourself, leading to a rejection of your auto loan approval application.

Failing to Provide Accurate or Complete Documentation

Missing or incorrect documents can delay or derail your auto loan approval. Always double-check requirements and ensure that all information matches across documents.

Tips to Improve Your Chances of Auto Loan Approval

If you’re worried about qualifying, there are proactive steps you can take to enhance your chances of securing auto loan approval.

Improve Your Credit Score

Pay off existing debts, correct any errors on your credit report, and avoid new credit inquiries in the months leading up to your application. A better credit score can unlock more favorable loan options.

Save for a Larger Down Payment

A higher down payment not only reduces the loan amount but also demonstrates financial responsibility. This increases lender confidence and enhances your auto loan approval prospects.

Lower Your Debt-to-Income Ratio

Pay down credit cards and other debts to improve your DTI. This is a key metric lenders use to assess your ability to handle a new loan.

Build a Strong Employment History

Longer tenure at your current job, or steady income in a consistent field, adds credibility to your application. Consistent income sources strengthen your case during auto loan approval reviews.

Get Pre-Approved

Apply for pre-approval with one or more lenders to understand the loan amount and interest rates you qualify for. Pre-approval letters can make you a more attractive buyer at the dealership.

Credit Score and Credit History

One of the most critical factors in the auto loan approval process is your credit score. This three-digit number is a reflection of your creditworthiness and is based on your history of managing debt. Lenders use credit scores to assess the risk involved in lending you money.

If you have a high credit score—typically above 700—you are more likely to receive auto loan approval quickly and with favorable terms. Borrowers with excellent credit often enjoy lower interest rates, higher loan amounts, and longer repayment periods. Conversely, those with a lower score may face higher interest rates or may need a co-signer or collateral to secure the loan.

Lenders will also examine your credit report to check for red flags such as late payments, bankruptcies, or accounts in collections. A strong credit history reassures lenders that you are a responsible borrower, improving your auto loan approval chances.

Income and Employment Stability

Stable income is another key requirement for auto loan approval. Lenders want to ensure that you have the financial means to repay the loan on time. Most institutions require proof of consistent income, typically through recent pay stubs, tax returns, or bank statements.

Some lenders may also require a minimum income threshold, depending on the loan amount and the cost of the vehicle. Self-employed individuals may need to provide additional documentation, such as business tax returns and profit/loss statements.

Equally important is employment stability. If you have been employed at the same company or in the same industry for several years, it demonstrates reliability, which can strengthen your auto loan approval application.

Debt-to-Income Ratio (DTI)

The Debt-to-Income Ratio (DTI) is one of the most important financial metrics lenders use when evaluating your eligibility for auto loan approval. It measures the relationship between your total monthly debt payments and your gross monthly income. In simpler terms, it helps lenders assess your ability to take on and manage new debt responsibly.

What Is Debt-to-Income Ratio (DTI)?

DTI is expressed as a percentage. It compares your total monthly debt obligations (including the potential auto loan payment) to your gross monthly income (income before taxes and deductions).

How to Calculate Your DTI

Here’s the basic formula for calculating DTI:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) × 100

Example:

- Total Monthly Debts: $1,500 (including credit card payments, rent or mortgage, student loans, and the estimated auto loan payment)

- Gross Monthly Income: $5,000

DTI = ($1,500 / $5,000) × 100 = 30%

In this example, your DTI is 30%, which is generally considered a healthy ratio for auto loan approval.

Why DTI Matters for Auto Loan Approval

Lenders use DTI to determine whether you can afford to repay a new auto loan in addition to your existing financial commitments. A high DTI signals that a large portion of your income is already tied up in debt, which may increase the risk of default on a new loan. A low DTI suggests you have enough financial flexibility to comfortably make additional loan payments.

Typical DTI Guidelines for Auto Loan Approval

- Excellent DTI (< 35%): Likely to receive fast and favorable auto loan approval.

- Acceptable DTI (36%–45%): Approval is possible but may come with slightly higher interest rates or shorter loan terms.

- High DTI (> 45%): Considered risky. May result in loan denial unless supported by strong credit or additional income documentation.

Some lenders might be more lenient, especially if you have a high credit score, a large down payment, or stable income. However, improving your DTI almost always increases your chances of successful auto loan approval.

What Debts Are Included in DTI?

When calculating your DTI, lenders typically include the following monthly obligations:

- Mortgage or rent payments

- Credit card minimum payments

- Student loan payments

- Personal loan payments

- Existing car loan payments

- Alimony or child support (if court-ordered)

- Any other monthly debt obligations

They do not include:

- Utility bills (electricity, water)

- Phone/internet services

- Groceries or gas

Down Payment

While not always mandatory, making a down payment can dramatically increase your chances of auto loan approval. A down payment reduces the total amount you need to borrow, thereby lowering the lender’s risk.

Putting down 10% to 20% of the vehicle’s price can also lead to better loan terms, including a lower interest rate and reduced monthly payments. In addition, a down payment demonstrates financial responsibility and commitment, which lenders view positively during the auto loan approval process.

Vehicle Information

| Vehicle Information Criteria | Description and Impact on Auto Loan Approval |

|---|---|

| Make and Model | Some makes and models hold value better over time. Lenders may favor vehicles known for reliability and resale value. |

| Vehicle Age | Newer vehicles are typically easier to finance. Older vehicles (usually over 10 years) may not qualify for standard auto loans. |

| Mileage | Lower mileage indicates less wear and tear, increasing loan approval chances. High-mileage vehicles are seen as higher risk. |

| Vehicle Identification Number (VIN) | Used to verify the car’s identity, accident history, and title status. Clean histories improve loan chances. |

| Condition (Mechanical & Cosmetic) | Lenders prefer vehicles in good condition. Cars with damage or required repairs may reduce loan options. |

| Title Status | A clean title is essential. Salvage or rebuilt titles can lead to denial or stricter loan terms. |

| Dealer vs. Private Seller | Buying from a reputable dealer may streamline auto loan approval. Private sales often require more documentation. |

| Vehicle Type (e.g., sedan, SUV, truck) | Certain types may be seen as more stable investments. Specialty or luxury cars can carry higher rates or down payment requirements. |

The car you plan to purchase plays a role in auto loan approval as well. Lenders assess the type, age, mileage, and condition of the vehicle to determine its value and resale potential.

Newer vehicles or certified pre-owned cars from reputable dealerships are often easier to finance because they hold their value better over time. In contrast, older or high-mileage cars may be harder to finance due to depreciation and higher risk for mechanical issues.

Lenders may also have restrictions on certain makes and models, particularly if the car is considered a luxury or specialty item. Providing complete and accurate information about the vehicle helps streamline the auto loan approval process.

Loan Term and Amount

The loan term and amount you request will influence your auto loan approval odds. Longer loan terms may lower monthly payments but result in higher overall interest. Lenders may scrutinize applications for longer terms more closely to ensure repayment feasibility.

Similarly, requesting a large loan relative to your income or the vehicle’s value may raise red flags. It’s best to request a realistic loan amount that aligns with your financial profile. A well-balanced loan request will strengthen your auto loan approval potential.

Co-Signer or Collateral

If your credit or income is not strong enough on its own, including a co-signer on your application can enhance your chances of auto loan approval. A co-signer shares legal responsibility for the loan and adds a layer of security for the lender.

Alternatively, offering collateral—such as another vehicle or valuable asset—can increase lender confidence and lead to more favorable terms. Collateral-based loans, also known as secured loans, are often easier to get approved, especially for applicants with weaker credit profiles.

Documentation Needed for Auto Loan Approval

To ensure a smooth auto loan approval process, you’ll need to provide several documents:

- Government-issued photo ID

- Proof of income (pay stubs, tax returns)

- Employment verification

- Credit report (usually pulled by the lender)

- Proof of residence (utility bills, lease agreement)

- Vehicle information (VIN, make, model, year)

- Proof of insurance

Having these documents ready in advance will expedite the auto loan approval process and reduce the chances of delays or rejection.

Also Read: Can a Commercial Loan Help You Grow Your Business?

Conclusion

Auto loan approval is a comprehensive process that hinges on multiple factors, including your credit score, income, debt levels, and the vehicle you intend to purchase. Understanding these requirements and preparing accordingly can not only improve your approval chances but also help you secure better terms and lower interest rates.

Taking the time to evaluate your credit profile, save for a down payment, and gather the necessary documentation can make a significant difference. Whether you’re buying your first car or upgrading to a newer model, understanding how auto loan approval works puts you in a stronger position to make informed financial decisions.

FAQs

What credit score is needed for auto loan approval?

Most lenders require a minimum score of around 600, but higher scores (above 700) improve your chances of auto loan approval with better rates.

Can I get auto loan approval with bad credit?

Yes, but you may face higher interest rates or need a co-signer or larger down payment. Specialized lenders offer subprime loans for this purpose.

How long does it take to get auto loan approval?

Some lenders offer instant decisions, while others may take a few days. Pre-approval processes can expedite final auto loan approval.

Is a down payment required for auto loan approval?

Not always, but it can improve your auto loan approval chances and reduce your monthly payments and interest burden.

Can I get pre-approved for an auto loan?

Yes, many lenders offer pre-approval which gives you a clearer picture of your budget and strengthens your negotiation position at the dealership.

Do auto loans require full-time employment?

Not necessarily, but lenders do require proof of consistent income, which can come from part-time work, freelance income, or self-employment.

What if I’m self-employed? Can I still get auto loan approval?

Yes, but you’ll need to provide additional documents such as tax returns, bank statements, and proof of business income to qualify.