Choosing the best life insurance policy is a critical decision that safeguards your family’s financial future. Life insurance provides peace of mind by ensuring that your loved ones are protected financially in case of your untimely death. However, the process of selecting the right policy can be overwhelming due to the many types of life insurance, coverage options, riders, and insurers available.

This article aims to guide you through the process, helping you understand life insurance basics, types of policies, how to evaluate your needs, and how to pick the right policy for your unique situation

Key Takeaways

- Assess your personal and financial obligations carefully.

- Understand the types of policies and their benefits.

- Consider policy affordability and insurer reliability.

- Use riders to customize your coverage.

- Regularly review and update your policy to match life changes.

What is Life Insurance?

Life insurance is a contract between you and an insurance company, where you pay regular premiums in exchange for a death benefit paid to your beneficiaries upon your death. This benefit can help cover expenses such as funeral costs, mortgage payments, education fees, and daily living expenses.

Why Do You Need Life Insurance?

Life insurance is much more than just a financial product — it is a critical component of a solid financial plan that provides protection, security, and peace of mind. The primary purpose of life insurance is to offer financial support to your loved ones in case of your premature death. But why exactly do you need life insurance? Here’s an in-depth look at the many reasons and scenarios that make life insurance essential.

Income Replacement for Your Dependents

For most families, the primary reason to buy life insurance is to replace the lost income of a breadwinner. If you are the main source of income for your family, your sudden death could leave your dependents without the financial means to cover everyday expenses such as food, utilities, rent or mortgage payments, healthcare, and education.

Life insurance ensures that your family can maintain their standard of living and avoid financial hardship even when you are no longer there to provide for them.

Paying Off Debts and Financial Obligations

Most people accumulate debts throughout their lifetime — mortgages, car loans, student loans, credit cards, and personal loans. These debts don’t disappear when you die; they become the responsibility of your estate or your family members.

Life insurance can help cover these outstanding debts, preventing your loved ones from being burdened by large financial liabilities. This is especially important for long-term debts like home mortgages, which can be tens or hundreds of thousands of dollars.

Covering Funeral and Final Expenses

Funeral costs and related end-of-life expenses can be surprisingly high, often costing thousands of dollars. These costs can add stress and financial strain to grieving family members.

Life insurance policies typically pay out quickly, allowing your family to cover these expenses without dipping into their savings or facing financial hardship during a difficult time.

Providing for Your Children’s Future

If you have young children, life insurance is critical to ensure their needs are met if you pass away unexpectedly. Beyond daily expenses, life insurance can provide for your children’s education, extracurricular activities, healthcare, and even long-term financial security.

For parents, life insurance can ensure that their children’s dreams and opportunities are not limited by the loss of financial support.

Supporting Your Spouse and Dependents

If you have a spouse who depends on your income, life insurance can help them maintain financial stability, pay bills, and manage household expenses.

It can also provide funds for any dependents who may require special care, such as elderly parents or family members with disabilities.

Estate Planning and Wealth Transfer

Life insurance is an important tool in estate planning. The death benefit can help cover estate taxes or debts that might otherwise force your heirs to sell assets.

Moreover, life insurance proceeds can be used to create an inheritance for your beneficiaries, ensuring that your wealth is passed on according to your wishes.

Protecting Your Business Interests

If you own a business, life insurance can be used as “key person insurance” to protect the company from financial loss if a crucial partner or executive passes away.

Additionally, life insurance policies can fund “buy-sell agreements,” allowing surviving partners to buy out the deceased owner’s share smoothly.

Peace of Mind and Financial Security

Beyond financial reasons, life insurance offers intangible but invaluable peace of mind. Knowing that your loved ones will be taken care of financially allows you to live with confidence and security.

This assurance can reduce stress and help you focus on your present life without worrying excessively about the future.

Affordable Protection for a Limited Time

Life insurance, especially term life policies, can be surprisingly affordable, making it a cost-effective way to protect your family’s future during critical periods — like raising children or paying off a mortgage.

This affordability means that even modest earners can provide significant financial security to their families.

Supplementing Retirement and Savings

Certain types of life insurance, such as whole or universal life, include a cash value component that grows over time. This can supplement your retirement savings, provide funds for emergencies, or be borrowed against for other needs.

This dual function as protection plus investment makes life insurance a versatile financial tool.

Real-Life Scenarios Highlighting the Need for Life Insurance

- Single Parent with Young Children: Ensures children’s upbringing and education expenses are covered if the parent dies.

- Dual-Income Family with Mortgage: Protects the family home and replaces lost income to maintain lifestyle.

- Business Owner: Safeguards the business continuity and supports partners or employees.

- Young Professionals: Locks in affordable coverage early to protect future family plans.

- Retirees: Uses insurance for estate planning or to leave a legacy.

Types of Life Insurance Policies

Term Life Insurance

- Provides coverage for a specified period (e.g., 10, 20, or 30 years).

- Offers high coverage amounts at affordable premiums.

- Does not build cash value.

- Best for temporary needs such as income replacement or mortgage protection.

Whole Life Insurance

- Provides lifelong coverage.

- Includes a savings component (cash value) that grows over time.

- Premiums are higher than term insurance.

- Good for those looking for permanent coverage and an investment element.

Universal Life Insurance

- Flexible premiums and death benefits.

- Cash value grows based on interest rates.

- Allows policyholders to adjust premiums and coverage.

- Suitable for those who want adaptable coverage.

Variable Life Insurance

- Permanent coverage with an investment component.

- Cash value invested in sub-accounts like stocks or bonds.

- Offers growth potential but with investment risk.

- Suitable for those comfortable with market fluctuations.

How to Assess Your Life Insurance Needs

- Calculate your financial obligations: debts, mortgages, education, daily expenses.

- Consider your income replacement needs.

- Factor in future inflation and potential expenses.

- Use online calculators or consult financial advisors.

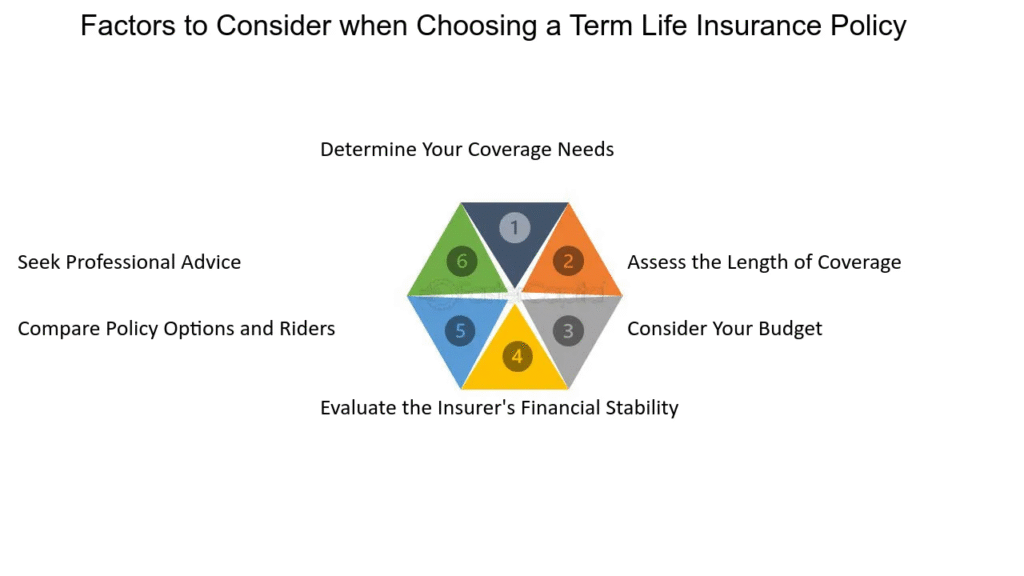

Factors to Consider When Choosing a Life Insurance Policy

Coverage Amount

- Enough to cover all your financial responsibilities.

- Typically 7-10 times your annual income.

Premium Affordability

- Ensure premiums fit your budget without strain.

Policy Term Length

- Align with the period your dependents need protection.

Riders and Additional Benefits

- Examples include critical illness, disability waiver, accidental death.

Financial Strength of the Insurer

- Check insurer ratings from agencies like A.M. Best, Moody’s.

Comparing Life Insurance Quotes and Providers

- Use comparison tools and get multiple quotes.

- Review policy terms, exclusions, and benefits.

- Consider customer service and claim settlement reputation.

Common Life Insurance Riders Explained

When purchasing a life insurance policy, the base coverage provides essential financial protection, but many insurers offer additional options called riders. Riders are optional add-ons that customize your policy, enhancing its coverage or providing extra benefits tailored to your specific needs. They allow policyholders to address unique concerns without buying separate insurance policies.

Understanding common life insurance riders can help you make a more informed decision and ensure your policy covers more than just the basic death benefit.

What Are Life Insurance Riders?

A rider is an amendment or endorsement added to a life insurance policy that modifies the terms or coverage. Riders often come with an additional cost (added premium), but they can significantly increase the value and flexibility of your policy.

Some riders provide extra financial protection, while others allow benefits to be accessed during your lifetime under certain conditions.

Common Types of Life Insurance Riders

Accidental Death Benefit Rider (AD&D Rider)

- What it is: Provides an additional death benefit if you die as a result of an accident.

- How it works: If the cause of death is accidental (car accident, fall, etc.), your beneficiaries receive the standard death benefit plus an extra payout, which is usually a multiple of the base coverage.

- Who needs it: Individuals in high-risk jobs or lifestyles, or those seeking extra protection beyond natural causes of death.

- Cost: Generally affordable; often a small percentage increase in premium.

Waiver of Premium Rider

- What it is: Waives your life insurance premium payments if you become totally disabled or unable to work due to illness or injury.

- How it works: After a waiting period (usually 3-6 months), the insurer covers your premiums until you recover or reach a certain age.

- Who needs it: Those concerned about losing income due to disability but want to keep their life insurance intact.

- Cost: Adds a moderate increase in premium but offers valuable protection against losing coverage.

Critical Illness Rider

- What it is: Provides a lump sum payment if you are diagnosed with a specified critical illness covered by the rider.

- Common illnesses covered: Cancer, heart attack, stroke, kidney failure, major organ transplant.

- How it works: You receive a portion or the entire death benefit early to cover treatment costs, rehabilitation, or income replacement.

- Who needs it: Individuals wanting financial help to cover expensive medical care without dipping into savings.

- Cost: Can significantly increase premiums depending on the illnesses covered.

Child Term Rider

- What it is: Provides life insurance coverage for your children under your policy.

- How it works: Covers your child(ren) for a specified term or until a certain age with a death benefit usually much smaller than your own.

- Who needs it: Parents wanting to provide a financial safety net for their children or lock in future insurability.

- Cost: Relatively low additional premium.

Guaranteed Insurability Rider

- What it is: Allows you to purchase additional coverage at specified intervals or life events without providing further medical evidence.

- How it works: At pre-defined times (e.g., every few years, marriage, birth of child), you can increase your coverage amount without a new medical exam.

- Who needs it: Those who expect their insurance needs to grow but want to avoid the risk of becoming uninsurable.

- Cost: Adds to premiums but offers valuable flexibility.

Long-Term Care Rider

- What it is: Provides benefits that help cover long-term care expenses such as nursing home stays, home health care, or assisted living.

- How it works: This rider allows access to part of your death benefit while alive if you require long-term care, reducing the death benefit accordingly.

- Who needs it: Older adults concerned about the high cost of long-term care who want to combine insurance needs.

- Cost: Typically expensive due to the high potential benefit.

Return of Premium Rider

- What it is: Returns all or a portion of the premiums you paid if you outlive the term of your policy.

- How it works: If you survive the policy term without a claim, the insurer refunds your premiums or a percentage of them.

- Who needs it: Individuals wanting some guarantee that their premiums won’t be “lost” if they don’t die during the term.

- Cost: Usually the most expensive rider due to the refund feature.

Disability Income Rider

- What it is: Provides monthly income if you become disabled and cannot work.

- How it works: Supplements your income to help maintain your lifestyle while disabled, usually after a waiting period.

- Who needs it: Those without sufficient disability coverage who want extra protection.

- Cost: Moderate increase in premium; riders may have limits on the duration of income benefits.

How to Apply for Life Insurance

Applying for life insurance is a crucial step towards securing your financial future and protecting your loved ones. While the process might seem overwhelming at first, understanding the steps involved can make it straightforward and manageable. This guide walks you through the complete process of applying for life insurance, from preparation to policy issuance.

Assess Your Insurance Needs

| Factor | Description | Estimated Amount | Notes / Calculation Tips |

|---|---|---|---|

| Income Replacement | Amount needed to replace your annual income for dependents | Annual Income × Number of Years (5-20 years) | Consider how many years your family would need financial support |

| Outstanding Debts | Mortgages, car loans, personal loans, credit card balances | Total Outstanding Loan Amount | Include all major debts your family would need to pay off |

| Final Expenses | Funeral costs, burial, medical bills, legal fees | $10,000 – $20,000 (average estimate) | Funeral and medical expenses vary by region; get local average costs |

| Education Costs | Future education expenses for children or dependents | Tuition × Number of Years × Number of Children | Consider college or private school costs; include inflation adjustment |

| Living Expenses | Daily household expenses (food, utilities, childcare) | Monthly Expenses × Number of Months / Years | Estimate how much family needs to maintain lifestyle |

| Emergency Fund | Additional money for unexpected expenses | 3-6 months of household expenses | Acts as a buffer for unforeseen costs |

Before applying, determine how much coverage you need and what type of policy best suits your situation.

- Calculate coverage amount: Consider your income, debts (mortgage, loans), daily living expenses, education costs for children, and future financial goals.

- Choose policy type: Term life (coverage for a specific period), whole life (permanent coverage with savings component), universal life (flexible premiums and benefits), or others.

- Decide on riders: Think about optional add-ons like critical illness or waiver of premium riders.

Many insurers provide online calculators or work with insurance advisors to help you estimate the right amount.

Research and Compare Life Insurance Companies

Not all insurance companies are created equal. Compare them based on:

- Financial strength and reputation: Look for insurers with high credit ratings (e.g., from A.M. Best, Moody’s).

- Policy options: Check available plans, riders, and flexibility.

- Premium costs: Obtain quotes for similar coverage to find competitive rates.

- Customer service: Read reviews, check complaint ratios, and evaluate claims processing.

You can do this research online, through insurance brokers, or by consulting independent advisors.

Fill Out the Application Form

Once you select a company and policy type, the next step is to complete the application. This can often be done:

- Online

- Over the phone

- In-person with an agent

Information Required

The application will request detailed personal information, such as:

- Name, date of birth, and contact details

- Social Security number (for identification)

- Occupation and income

- Lifestyle habits (smoking, alcohol consumption, exercise)

- Medical history (pre-existing conditions, surgeries)

- Family medical history

- Details about hazardous activities (skydiving, scuba diving)

- Coverage amount and beneficiaries

It’s important to answer truthfully and completely, as misrepresentation can void the policy.

Undergo Medical Examination (if required)

Most life insurance policies, especially larger amounts, require a medical exam to assess your health. The insurer arranges for a paramedical professional to visit you at home or your workplace, or you may visit a clinic.

What the exam involves:

- Measurement of height, weight, blood pressure, and pulse

- Blood and urine samples

- Sometimes an EKG (electrocardiogram) for heart health

- Questions about your medical history and lifestyle

Some simplified or no-exam policies are available, but they often come at a higher premium or offer lower coverage.

Medical Records and Additional Documentation

The insurer may request your medical records from doctors or hospitals to verify your health condition. You may need to sign release forms for this.

You might also need to provide additional documents:

- Proof of identity (driver’s license, passport)

- Proof of income or employment (pay stubs, tax returns)

Application Review and Underwriting

After receiving your application, medical exam results, and documentation, the insurance company’s underwriting department reviews everything to assess risk.

Underwriting evaluates:

- Your health status and medical history

- Age and gender

- Occupation and hobbies

- Family medical history

- Lifestyle habits (smoking, alcohol, drugs)

Based on this, they classify you into a risk category and determine your premium rate.

- Preferred Risk: Healthier than average, lower premium

- Standard Risk: Average health and lifestyle

- Substandard Risk: Higher risk, higher premium or exclusions

This process can take anywhere from a few days to several weeks depending on complexity.

Policy Approval and Issuance

Once underwriting is complete, the insurer will:

- Approve your application and issue the policy documents

- Inform you of your premium amount and payment schedule

- Provide you with a copy of the policy contract

Review the policy carefully to ensure all information is accurate and coverage meets your expectations.

Pay Your First Premium

To activate your policy, you must pay the initial premium. Payment options often include:

- Monthly, quarterly, or annual payments

- Automatic bank drafts

- Online payments or checks

Your coverage officially begins once the premium is received, or on the policy start date indicated.

Keep Your Policy Updated and Review Regularly

After your policy is in force:

- Keep your beneficiary information current.

- Review your coverage periodically (every 1-2 years) to ensure it still meets your needs.

- Update your insurer on any major life changes (marriage, birth of a child, job change).

- Pay premiums on time to avoid lapse.

Mistakes to Avoid When Choosing Life Insurance

- Underinsuring or overinsuring.

- Not reviewing policy regularly.

- Ignoring exclusions or fine print.

- Buying without comparing options.

How to Review and Update Your Life Insurance Policy

- Reassess needs after major life events.

- Increase coverage or add riders if needed.

- Update beneficiaries.

Also Read: What Does an Insurance Agent Do?

Conclusion

Choosing the best life insurance policy involves understanding your needs, comparing options, and selecting a policy that balances coverage, cost, and benefits. With careful planning and informed decisions, life insurance can provide essential financial security for you and your loved ones.

FAQs

1: How much life insurance do I really need?

Generally, 7-10 times your annual income, but it varies based on personal obligations.

2: What’s the difference between term and whole life insurance?

Term is temporary and cheaper; whole life is permanent with a cash value component.

3: Can I convert my term life policy to whole life?

Many policies allow conversion during the term without medical exams.

4: Are premiums fixed or can they increase?

Term premiums are usually fixed; universal and variable life may vary.

5: How does the cash value component work?

It grows over time and can be borrowed against or withdrawn.

6: What happens if I miss a premium payment?

Policies often have a grace period; unpaid premiums can lead to policy lapse.

7: Can I have more than one life insurance policy?

Yes, many people hold multiple policies to meet different needs.