Buying Best Home Insurance is an essential step for homeowners to protect their most valuable asset: their home. But as with any insurance, rates can vary significantly based on numerous factors. Getting the best home insurance rates is not just about finding the cheapest policy — it’s about balancing cost with coverage to ensure you’re adequately protected without overpaying.

In this article, we’ll explore practical strategies for securing the Best Home Insurance rates. We will cover everything from understanding how Best Home Insurance price policies to actionable steps you can take to reduce premiums. Additionally, we’ll include common questions homeowners ask about home insurance, a detailed conclusion, and key takeaways to help you make informed decisions.

Key Takeaways

- Shop and compare multiple quotes to find competitive rates.

- Increase deductibles to lower premiums but ensure affordability.

- Bundle insurance policies for discounts.

- Improve home safety and security features to qualify for discounts.

- Maintain a good credit score to reduce insurance costs.

- Avoid small claims to keep premiums stable.

- Review your policy annually to adjust coverage as needed.

- Understand what your policy covers and add additional coverage for specific risks.

Understanding Best Home Insurance Rates

Before diving into how to get the best rates, it’s important to understand how insurers calculate those rates in the first place.

Location, Location, Location

One of the biggest influences on your Best Home Insurance rate is where your home is located.

Why Location Matters

- Risk of Natural Disasters:

Homes in areas prone to hurricanes, tornadoes, earthquakes, floods, or wildfires tend to have higher premiums because of the increased likelihood of damage. - Crime Rates:

Neighborhoods with high crime rates often see higher insurance costs due to increased risk of theft, vandalism, or property damage. - Proximity to Fire Services:

Insurance companies consider how close your home is to a fire station or fire hydrant. The quicker fire services can respond, the lower the risk of extensive fire damage. - Local Building Codes and Costs:

Different regions have different construction costs and building codes that can affect the cost to rebuild or repair your home.

How to Use Location to Your Advantage

- If you are house hunting, research insurance rates in different neighborhoods to find safer areas with lower premiums.

- Consider investing in additional protections if you live in a high-risk area, like fire-resistant roofing or storm shutters, which can reduce your premiums.

Characteristics of Your Home

Insurers evaluate your home’s physical attributes to estimate the risk of damage or loss.

Key Home Attributes Affecting Rates

- Age of the Home:

Best Home Insurance are often more expensive to insure because they may have outdated electrical, plumbing, or structural systems that increase risk. - Construction Materials:

Homes built with brick or stucco often have lower premiums compared to those built with wood or vinyl siding, as they resist fire and weather damage better. - Roof Condition and Type:

The age and material of your roof matter. Newer roofs and impact-resistant roofing materials (like metal or asphalt shingles rated for hail) can lower premiums. - Home Size and Layout:

Larger homes or homes with complicated layouts cost more to rebuild, increasing insurance premiums. - Foundation Type:

Best Home Insurance with basements or slab foundations may have different risks (e.g., flood or moisture damage) that influence rates.

Tips to Improve Your Home’s Insurability

- Keep up with regular maintenance to prevent issues like leaks or faulty wiring.

- Best Home Insurance older systems to modern, safer versions.

- Replace your roof before it becomes a liability.

Coverage Amount and Deductibles

The type and amount of coverage you choose directly impact your insurance rate.

Understanding Coverage Types

- Dwelling Coverage:

Best Home Insurance Covers the physical structure of your home. - Personal Property Coverage:

Protects belongings inside your home. - Liability Coverage:

Covers you if someone is injured on your property. - Additional Living Expenses (ALE):

Pays for temporary living costs if your home is uninhabitable due to a covered loss.

Impact of Coverage Limits and Deductibles

- Coverage Limits:

Best Home Insurance Higher coverage limits mean the insurer pays more in the event of a claim, so premiums increase. - Deductibles:

A deductible is the amount you pay out of pocket before insurance covers the rest. Choosing a higher deductible usually lowers your premium but increases your financial risk.

Claims History and Insurance Score

Your personal history with Best Home Insurance claims plays a significant role in your rates.

- Frequent Claims:

Multiple claims, especially in a short time, signal higher risk and can cause insurers to raise rates or even refuse coverage. - Type of Claims:

Certain claims, like water damage or theft, may weigh more heavily than others. - Insurance Score:

Best Home Insurance use an insurance score that factors in your claims, payment history, and credit data to assess risk.

Credit Score

In many states, insurers legally use credit scores as a factor in setting rates.

Why Credit Scores Matter

- Studies show a correlation between lower credit scores and higher claim rates.

- Best Home Insurance view a good credit score as an indicator of responsible behavior, resulting in lower premiums.

Improving Your Credit to Lower Insurance Costs

- Pay bills on time.

- Reduce outstanding debts.

- Check your credit report annually for errors and dispute inaccuracies.

Safety and Security Features

Homes equipped with safety devices can benefit from reduced Best Home Insurance premiums.

Common Safety Features That Lower Rates

- Smoke Detectors and Fire Alarms:

Required by law in most places, but insurers still reward homes with these features. - Burglar Alarms and Security Systems:

Monitored systems provide significant discounts because they reduce theft risk. - Deadbolt Locks and Security Bars:

Additional physical security lowers risk of break-ins. - Fire Sprinkler Systems:

Reduce fire damage and help lower rates. - Storm Shutters and Reinforced Doors:

Protect against wind and hail damage in storm-prone areas.

Homeowner’s Occupation and Lifestyle Factors

Certain personal factors can influence premiums, though less directly.

- Working from Home:

If you have a home business or work remotely, you may need additional coverage. - Pets:

Certain dog breeds deemed “dangerous” by insurers can increase liability risk. - Smoking:

Homes where residents smoke may have higher fire risk and premiums.

Market Conditions and Insurance Company Factors

Finally, Best Home Insurance rates are also influenced by broader market dynamics and company-specific factors.

- State Regulations:

Best Home Insurance rates are regulated at the state level, affecting how much companies can charge. - Company Financial Strength:

Some insurers may charge more or less depending on their risk appetite. - Claims Trends:

Natural disaster frequency and rising rebuilding costs can drive rates up across the board.

Summary of Key Points Understanding Home Insurance Rates

| Factor | Impact on Rate | Tips to Lower Rates |

|---|---|---|

| Location | High-risk areas = higher premiums | Choose safer neighborhoods, add protection |

| Home Age & Construction | Older, wood homes cost more | Upgrade systems, maintain home |

| Coverage Amount & Deductible | Higher coverage & lower deductibles = higher premiums | Increase deductible, buy adequate coverage |

| Claims History | Frequent claims increase premiums | Avoid small claims |

| Credit Score | Poor score increases premiums | Improve credit behavior |

| Safety Features | Security systems reduce premiums | Install alarms, locks, sprinklers |

| Personal & Lifestyle Factors | Some pets, smoking increase risk | Disclose accurately, consider risks |

| Market & Company Factors | Regional regulations and insurer factors | Shop around for competitive rates |

What Factors Influence Home Insurance Rates?

- Location of the Home

Best Home Insurance companies assess risks based on your home’s location. Areas prone to natural disasters (floods, earthquakes, hurricanes), crime rates, and proximity to fire departments all impact rates. - Home Characteristics

The age, size, construction type, and condition of your home affect premiums. Older homes may have outdated wiring or plumbing, increasing risk. Materials used for construction (e.g., brick vs. wood) also matter. - Coverage Amount and Deductible

The level of coverage you choose and your deductible amount (the out-of-pocket cost you pay before insurance kicks in) directly affect your premium. Higher coverage and lower deductibles mean higher premiums. - Claims History

If you have a history of filing claims, insurers may charge more, seeing you as higher risk. - Credit Score

In many states, insurance companies use credit scores to gauge risk and set premiums. - Safety and Security Features

Homes with smoke detectors, burglar alarms, deadbolt locks, and sprinkler systems often get discounts.

How to Get the Best Home Insurance Rates: Step-by-Step Guide

Shop Around and Compare Quotes

One of the simplest but most effective ways to get the best rate is to get quotes from multiple insurers. Rates can vary significantly between companies for the same coverage. Use online comparison tools or work with an independent Best Home Insurance agent who can offer policies from different providers.

Increase Your Deductible

Raising your deductible reduces your premium because you’re agreeing to pay more out of pocket in case of a claim. Just ensure you can afford the deductible amount if you need to file a claim.

Bundle Policies

Best Home Insurance offer discounts if you purchase multiple types of insurance (home, auto, life) through them. Bundling policies can often save you 10-25% or more.

Improve Home Security and Safety

Installing smoke detectors, fire extinguishers, security systems, and deadbolt locks can qualify you for discounts. Some insurers also offer discounts if you upgrade your home’s electrical, plumbing, or heating systems.

Maintain a Good Credit Score

Since credit scores affect rates, maintaining or improving your credit can lower your premium. Pay bills on time, reduce debt, and check your credit reports for errors.

Avoid Small Claims

Frequent claims can increase premiums. For minor repairs, consider paying out of pocket instead of filing a claim. Save claims for major losses.

Review and Update Your Coverage Regularly

Best Home Insurance needs can change over time. Renovations, adding expensive belongings, or changes in market value might require adjustments. Review your policy annually to ensure you’re not under or over-insured.

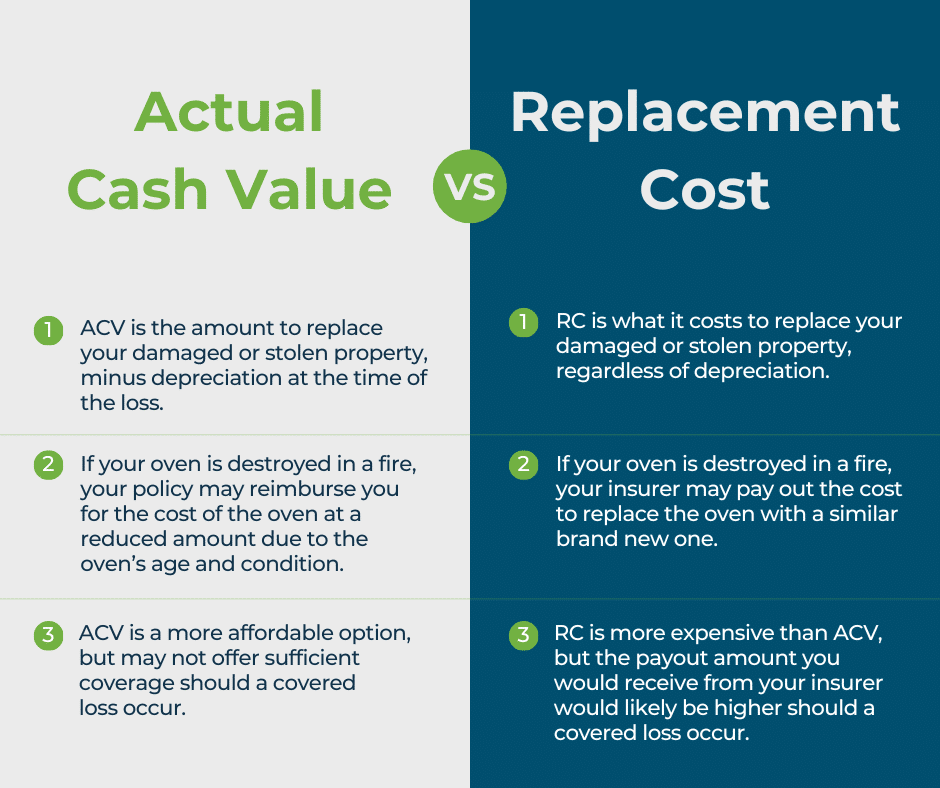

Choose Replacement Cost Coverage Wisely

Replacement cost policies cover rebuilding your home at today’s prices, while actual cash value policies take depreciation into account. Replacement cost coverage is more expensive but may save you money in the long run after a loss.

Take Advantage of Discounts

Ask your insurer about discounts for things like being a non-smoker, having a claims-free history, loyalty discounts, or being a member of certain professional organizations.

Consider Location Carefully When Buying a Home

If you’re still house hunting, keep insurance costs in mind. Buying in a safer neighborhood, or an area less prone to natural disasters, can save thousands in premiums.

Write an best article on “How Can I Get the Best Home Insurance Rates?” and also add 7 FAQs and conclusion and also add key takeaway with it at the end 10000 words

Advanced Strategies for Securing the Best Home Insurance Rates

While basic tips like shopping around and bundling policies are well-known, there are several advanced strategies and insights savvy homeowners can leverage to get the best possible rates.

Leverage Home Improvements to Lower Your Premium

Best Home Insurance upgrades can significantly reduce your risk profile in the eyes of insurers. For example:

- Impact-resistant Roofing: Installing Class 4 impact-resistant shingles or metal roofing can lower rates, especially in hail-prone regions.

- Modern Wiring and Plumbing: Older homes often have outdated systems that increase fire and water damage risk. Upgrading these can reduce premiums.

- Storm-proofing: Reinforced doors, storm shutters, and hurricane clips can earn discounts in storm-prone areas.

Before investing, check with your insurer about which upgrades qualify for discounts.

Understand the Difference Between Replacement Cost and Actual Cash Value Policies

- Replacement Cost Coverage reimburses the full cost to repair or rebuild your home with materials of similar kind and quality without deduction for depreciation.

- Actual Cash Value Coverage reimburses you for the depreciated value of your home or belongings.

While replacement cost coverage usually costs more, it provides better protection. You might save money on premiums by choosing actual cash value, but that could mean substantial out-of-pocket costs after a claim.

Utilize Loyalty and Long-Term Customer Discounts

Best Home Insurance companies reward customers who stay with them for several years by offering loyalty discounts or no-claims bonuses. While it’s smart to shop around, don’t overlook the value of sticking with a reputable insurer who rewards your loyalty.

Pay Your Premium Annually Instead of Monthly

Some insurers charge additional fees or higher rates if you pay your premium monthly rather than annually. Paying upfront can sometimes save you money.

Join Professional Associations or Alumni Groups

Best Home Insurance provide discounts to members of certain professional groups, unions, alumni associations, or credit unions. It never hurts to ask.

Review Your Policy for Unnecessary Coverage

If you have coverage that you don’t need — like insuring a detached garage separately when it’s already included — removing these can lower your premium.

Increase Home Security with Smart Technology

Modern smart home devices like water leak detectors, smart smoke alarms, and security cameras not only protect your home but also qualify you for insurance discounts.

Take Advantage of Seasonal Discounts or Promotions

Best Home Insurance run promotions or seasonal discounts. Signing up for newsletters or checking websites regularly can alert you to these savings opportunities.

Factors That Could Unexpectedly Raise Your Premiums — And How to Avoid Them

Awareness of pitfalls that cause premium spikes is essential for maintaining the best rates.

Filing Multiple Small Claims

Although it may be tempting to claim small damages, frequent claims signal higher risk to insurers. This can result in higher rates or even policy cancellation.

Failure to Maintain Your Property

Neglecting repairs or home maintenance can increase the likelihood of damage, leading insurers to raise premiums or deny claims.

Changes in Credit Score or Financial Situation

A sudden drop in credit score can increase rates. Monitor your credit and keep financial health stable.

Adding High-Risk Features

Pools, trampolines, or certain dog breeds increase liability risk and thus your insurance costs.

Moving to High-Risk Areas

If you relocate to areas with high crime, natural disasters, or fire risk, expect higher premiums.

The Role of Insurance Agents and Brokers in Finding the Best Rates

Best Home Insurance professionals can be valuable allies.

- Independent Brokers work with multiple insurers and can help you compare more options.

- Captive Agents sell policies for one insurer but often have deep knowledge of that company’s discounts.

Building a relationship with a trusted agent can help you navigate the market, understand policy nuances, and uncover less obvious discounts.

How to Effectively Shop for Best Home Insurance

Assess Your Insurance Needs

- Determine your home’s replacement cost.

- List valuable personal belongings.

- Consider your liability needs.

Gather Multiple Quotes

- Use online comparison tools.

- Contact independent insurance agents.

- Ask friends or family for recommendations.

Review Policy Details Thoroughly

- Compare deductibles, coverage limits, and exclusions.

- Understand additional endorsements or riders needed.

Negotiate and Ask for Discounts

- Don’t hesitate to ask insurers for better rates or applicable discounts.

Monitor Your Policy Annually

- Update your coverage with home improvements or changes.

- Shop around again regularly to ensure competitive pricing.

Common Mistakes to Avoid

- Buying insurance based on price alone — Low premiums might mean less coverage or higher out-of-pocket costs.

- Not reading policy details — Understand exclusions, limits, and conditions.

- Failing to disclose accurate information — Misrepresenting facts can lead to denied claims.

- Ignoring flood or earthquake insurance — Standard policies typically exclude these risks.

Also Read: What Does an Insurance Agency Do?

Conclusion

Securing the Best Home Insurance rates requires a strategic approach. By understanding how insurers price policies, shopping around, maintaining your home, and improving your personal risk factors like credit score, you can significantly reduce your premiums. It’s also important to strike a balance — getting the cheapest rate without compromising on adequate coverage.

Remember, your home is a valuable asset, and your insurance should protect it sufficiently. Taking time to review your policy regularly and making informed adjustments can ensure you get the best value for your money.

FAQs

1. How much home insurance coverage do I really need?

Most experts recommend insurance coverage equal to the cost to rebuild your home, not the market value. This includes materials and labor costs.

2. Does my home insurance cover natural disasters like floods or earthquakes?

Typically, no. Flood and earthquake coverage usually require separate policies or endorsements.

3. Can I get home insurance with a poor credit score?

Yes, but your premiums may be higher. Improving your credit can reduce rates over time.

4. What is a deductible, and how does it affect my premium?

A deductible is the amount you pay before insurance covers a claim. Higher deductibles usually mean lower premiums.

5. Will making claims increase my insurance rates?

Filing claims, especially multiple claims, can raise your premiums or cause insurers to drop your policy.

6. How often should I review my home insurance policy?

At least once a year or after major changes to your home or possessions.

7. Can I negotiate my home insurance rates?

While rates are often set, you can negotiate by shopping around, bundling, improving home safety, or adjusting deductibles.