Access to capital is one of the most important factors for business growth and sustainability. Whether you are a small startup or an established company looking to expand, securing adequate financing can be a challenge. This is where a Commercial Loan can make a significant difference. A Loan offers businesses the financial support they need to take crucial steps toward growth — from purchasing equipment and expanding operations to increasing inventory or entering new markets.

In this comprehensive guide, we will explore how a Loan can help grow your business, the different types available, the benefits and risks involved, and strategic considerations for making the most of this financial tool. We will also answer some frequently asked questions to help you better understand the nuances of commercial lending.

Key Takeaways

- A Commercial Loan provides businesses with essential funding for growth-related activities.

- Various types of loans exist to meet different business needs, including term loans, lines of credit, and equipment financing.

- Using a Commercial Loan allows for larger capital access, lower interest rates (especially when secured), and flexible repayment terms.

- Proper financial planning and clear growth objectives are critical when applying for and managing a Loan.

- Collateral often helps secure better loan terms but comes with the risk of asset loss if repayments are missed.

- Timely repayment of a Commercial Loan can build business credit and improve future borrowing options.

- Businesses should avoid overborrowing and only use commercial loans as part of a comprehensive growth strategy.

What is a Commercial Loan?

A Commercial Loan is a type of financing specifically designed for business purposes. Unlike personal loans, a Loan is structured to provide capital to businesses for operational needs, expansion projects, or asset purchases. These loans can vary in size, repayment terms, and security requirements depending on the lender and borrower’s profile.

A Commercial Loan can be secured or unsecured. Secured loans require collateral such as property, equipment, or receivables, which provides the lender with assurance that the loan will be repaid. Unsecured loans, by contrast, rely primarily on the business’s creditworthiness and generally come with higher interest rates due to increased risk.

How Can a Commercial Loan Help Your Business Grow

Growing a business typically requires resources beyond what daily operations generate. Whether you want to expand your product line, open a new location, upgrade equipment, or improve your cash flow, access to adequate financing is often the cornerstone of successful growth. A Loan is one of the most effective financing options businesses can leverage to unlock their growth potential.

Here’s a detailed breakdown of how a Commercial Loan can help your business grow:

Providing Capital for Expansion

One of the primary ways a Commercial Loan fuels business growth is by providing the capital needed to expand. Growth opportunities often require substantial upfront investment, whether it’s opening additional locations, entering new markets, or increasing production capacity. Instead of waiting to accumulate enough profits, a loan gives you immediate access to funds, allowing you to act swiftly on growth opportunities.

For example, a retail chain wanting to open new outlets can use a Loan to finance lease deposits, renovations, inventory purchases, and initial marketing expenses. By borrowing, the business can accelerate its expansion timeline and start generating additional revenue sooner.

Purchasing Equipment and Technology

Modern businesses rely heavily on technology and equipment to stay competitive. Whether you run a manufacturing plant, a restaurant, or a tech firm, having up-to-date tools is crucial for efficiency and quality. A Commercial Loan allows you to invest in state-of-the-art machinery, computers, software, or vehicles that can improve productivity and reduce costs in the long run.

Rather than depleting cash reserves or disrupting operational budgets, businesses can use loans—sometimes structured specifically as equipment financing—to spread the cost of these investments over time while benefiting immediately.

Improving Cash Flow Management

Cash flow challenges are a common barrier to growth, especially for seasonal businesses or those experiencing rapid increases in demand. A Commercial Loan can serve as a financial cushion, ensuring you have the liquidity necessary to cover day-to-day expenses such as payroll, supplier payments, and rent while pursuing growth initiatives.

For example, a business might receive large orders but have to wait weeks for payment. A loan can bridge that gap, allowing the company to purchase raw materials and hire staff without interruption. This ensures smooth operations and enhances the ability to scale efficiently.

Expanding Marketing and Sales Efforts

Growth often hinges on attracting new customers and increasing sales volume. To do this effectively, businesses need to invest in marketing campaigns, sales teams, and promotional activities. A Commercial Loan provides the funds necessary to boost your brand presence, run advertising campaigns, optimize online marketing, or attend industry trade shows.

This type of investment can generate new leads, improve conversion rates, and ultimately increase revenue. Without a commercial loan, businesses might be limited to slow organic growth, missing out on potentially lucrative markets.

Hiring and Training Staff

Scaling a business means more than just infrastructure; it requires skilled human resources. Hiring new employees and providing training are investments that directly contribute to your company’s capacity to deliver products or services effectively.

Using a Loan, businesses can afford recruitment costs, salaries, onboarding programs, and employee development initiatives without compromising other financial obligations. This creates a stronger workforce capable of supporting larger operations and enhancing customer satisfaction.

Refinancing Existing Debt

Sometimes, growth is hindered by high-interest debt or unfavorable loan terms. A Loan can be used to refinance existing debt, consolidating it into a single loan with better interest rates and repayment conditions. This reduces financial strain and frees up cash flow, which can then be redirected toward growth initiatives.

Effective debt management through refinancing is a smart way to strengthen your financial position and invest more confidently in expansion projects.

Entering New Markets

Exploring new geographic or demographic markets can be costly. You might need to establish new distribution channels, create localized marketing materials, or adapt your products to meet local preferences. A Commercial Loan can provide the financial resources necessary to undertake these activities without jeopardizing your existing operations.

By strategically investing loan proceeds, businesses can diversify revenue streams and reduce dependence on a single market, enhancing overall resilience and growth potential.

Enhancing Inventory and Supply Chain

To meet increasing customer demand, businesses need to maintain adequate inventory levels and optimize their supply chains. A Commercial Loan can finance larger inventory purchases at discounted rates or allow investment in supply chain technology and logistics. This leads to faster order fulfillment, improved customer satisfaction, and the ability to take on bigger contracts.

Why a Commercial Loan is Often Preferable for Growth Financing

- Large Amounts of Capital: Commercial loans typically provide larger sums than credit cards or personal loans, enabling more significant investments.

- Structured Repayment Terms: Businesses can choose repayment schedules that match cash flow cycles.

- Potential Tax Benefits: Interest payments on loans are usually tax-deductible.

- Preserves Ownership: Unlike equity financing, loans don’t require you to give up control or ownership stakes.

- Builds Creditworthiness: Responsible repayment strengthens your business credit profile for future financing.

Strategic Use of a Commercial Loan for Growth

To maximize the impact of a Commercial Loan on your business growth, consider the following strategies:

Communicate with Lenders: Maintain transparency with your lender about your business plans and financial status to build trust and potentially negotiate better terms in the future.

Set Clear Objectives: Define specific goals for how the loan proceeds will be used and how they will contribute to revenue or profit growth.

Conduct ROI Analysis: Estimate the return on investment for each planned use of loan funds to prioritize the most impactful expenditures.

Align Loan Terms with Business Cycles: Choose repayment schedules that fit your business’s cash flow patterns.

Maintain Financial Discipline: Avoid using loan proceeds for non-essential expenses and monitor budgets closely.

Types of Commercial Loans to Consider

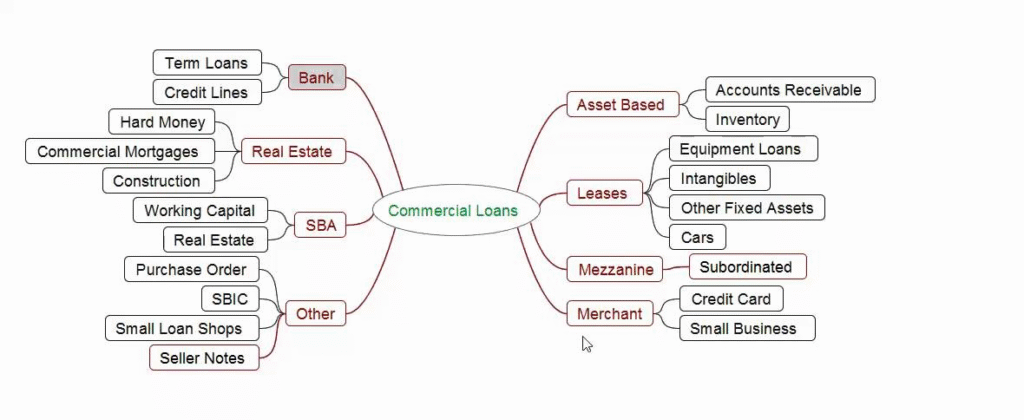

There are several types of Commercial Loans, each with its unique features tailored to different business needs:

- Term Loans: These loans provide a lump sum that is repaid over a fixed term with interest. Term loans are suitable for long-term investments such as buying equipment or expanding facilities.

- Lines of Credit: This flexible option lets businesses borrow up to a certain limit and repay as needed, making it ideal for managing ongoing expenses or seasonal fluctuations.

- Equipment Financing: A specialized loan used to purchase machinery or equipment. The equipment often serves as collateral.

- Commercial Real Estate Loans: Used to buy, build, or refinance commercial property, these loans typically involve large sums and longer repayment terms.

- Invoice Financing: Also called accounts receivable financing, this loan is based on outstanding invoices, providing quick access to cash.

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms but often have more stringent qualification criteria.

Choosing the right Commercial Loan depends on your business goals, asset base, and repayment capacity.

Benefits of a Commercial Loan

A Commercial Loan offers several distinct advantages that make it an attractive financing option for businesses:

- Access to Larger Amounts of Capital: Compared to personal financing or credit cards, a Commercial Loan enables businesses to borrow significantly larger sums.

- Flexible Repayment Terms: Many commercial loans come with flexible payment schedules, allowing businesses to manage cash flow while repaying debt.

- Lower Interest Rates: Especially for secured Commercial Loans, interest rates tend to be lower due to reduced lender risk.

- Build Business Credit: Timely repayment of a Commercial Loan helps build or improve your business credit profile.

- Maintain Equity: Unlike equity financing, loans don’t require you to give up ownership or control of your business.

- Tax Advantages: Interest paid on a Commercial Loan is usually tax-deductible, which can lower overall business expenses.

These benefits, when leveraged effectively, can provide a strong foundation for sustainable growth.

Risks and Considerations

While a Commercial Loan can be a powerful growth tool, it also carries risks and responsibilities that should not be overlooked:

- Debt Burden: Taking on a loan increases your business’s liabilities. Overborrowing or poor planning can lead to financial stress.

- Collateral Risk: Secured Commercial Loans require collateral, meaning you risk losing assets if you default.

- Approval Process: Commercial loans typically involve detailed financial documentation, credit checks, and sometimes asset appraisals. The process can be time-consuming.

- Interest and Fees: Depending on the loan type and lender, interest rates and fees can add significant costs.

- Cash Flow Impact: Regular loan repayments reduce available cash, which may affect daily operations if not managed properly.

Before applying for a Commercial Loan, it’s crucial to analyze your business’s financial health, cash flow projections, and growth strategy to ensure the loan will serve your goals.

When Should You Consider a Commercial Loan?

Determining the right time to seek a Commercial Loan is key to maximizing its benefits. Here are some scenarios where a Commercial Loan can be especially valuable:

- Launching a New Product or Service: When you have a clear market opportunity requiring upfront investment.

- Opening Additional Locations: Expanding your physical presence or service area.

- Increasing Production Capacity: When demand outpaces your current capability.

- Purchasing or Leasing Equipment: Acquiring tools necessary for efficiency and competitiveness.

- Managing Seasonal Cash Flow: Addressing predictable fluctuations in revenue.

- Consolidating Debt: Replacing high-interest debt with a more affordable loan.

Timing your Commercial Loan strategically ensures that you borrow when the investment will generate returns and not simply cover expenses.

How to Qualify for a Commercial Loan

| Qualification Criteria | Description |

|---|---|

| Business Credit Score | A strong business credit score demonstrates your company’s creditworthiness to lenders. |

| Personal Credit Score | Many lenders also review the personal credit score of business owners, especially for small businesses or startups. |

| Business Financial Statements | Includes income statements, balance sheets, and cash flow statements showing profitability and stability. |

| Time in Business | Lenders prefer businesses with a solid operational history, typically at least 2 years or more. |

| Debt Service Coverage Ratio (DSCR) | Measures your ability to cover loan payments from operating income; a higher ratio is favorable. |

| Collateral | Assets pledged to secure the loan, such as real estate, equipment, or inventory, which reduce lender risk. |

| Business Plan | A comprehensive plan outlining how the loan will be used and how it will help grow the business. |

| Tax Returns | Business and sometimes personal tax returns verify income and financial stability. |

| Cash Flow Projections | Detailed forecasts showing expected inflows and outflows to prove ability to repay the loan. |

| Industry Experience | Relevant experience in the business sector can improve lender confidence in your management capability. |

| Legal Documentation | Proper licenses, registrations, and other legal documents proving legitimacy of the business. |

| Existing Debt Obligations | Lenders assess your current debt levels to evaluate if you can take on additional loans. |

Qualifying for a Commercial Loan depends on several factors, and understanding these will improve your chances of approval:

- Credit Score: Both business and sometimes personal credit scores play a role in lender decisions.

- Business Financials: Lenders review income statements, balance sheets, cash flow statements, and tax returns to assess your financial health.

- Collateral: For secured loans, the value and condition of the collateral matter.

- Business History: Longer operating history generally improves loan prospects.

- Debt Service Coverage Ratio (DSCR): This ratio indicates your ability to repay debt from operating income.

- Business Plan: A clear plan demonstrating how the loan will help grow the business adds confidence for lenders.

Preparing detailed financial documents and a strong business case can improve your application success.

Tips for Making the Most of Your Commercial Loan

To maximize the impact of your Commercial Loan on business growth:

- Define Clear Objectives: Know exactly what the loan will fund and how it will contribute to growth.

- Plan Repayment Carefully: Align repayment schedules with cash flow projections.

- Keep Accurate Records: Monitor how loan funds are used and their outcomes.

- Communicate with Lenders: Maintain transparency, especially if you face difficulties.

- Avoid Overborrowing: Only borrow what you truly need.

- Review Loan Terms: Understand interest rates, fees, penalties, and covenants.

Sound financial management paired with the right Commercial Loan can turn borrowing into a growth catalyst.

Also Read: What Is a Secured Business Loan and How Does It Work?

Conclusion

A Commercial Loan is a vital financial tool that can significantly help your business grow when used strategically. It provides access to capital needed for expansion, equipment purchase, inventory management, and more. The diverse range of loan types allows businesses of all sizes and industries to find financing solutions tailored to their specific needs.

However, borrowing always comes with responsibilities and risks. Understanding the terms, planning for repayments, and ensuring that the loan aligns with your business goals are essential steps to harness the full potential of a Commercial Loan. With proper planning and management, a commercial loan can be the fuel your business needs to accelerate growth and achieve long-term success.

FAQs

What is the difference between a commercial loan and a business loan?

A business loan is a broad term for any loan used by a business, while a Commercial Loan usually refers to loans provided by banks or lenders specifically for commercial or corporate purposes and often involves larger amounts and stricter underwriting.

Can a startup get a commercial loan?

Startups can get a Commercial Loan, but they often need to offer collateral or have strong financial projections. Lenders may require a personal guarantee or additional documentation.

What types of collateral are accepted for commercial loans?

Collateral can include real estate, equipment, inventory, receivables, or other business assets. The type of collateral depends on the lender and loan type.

How long does it take to get approved for a commercial loan?

Approval can take from a few days to several weeks depending on the loan amount, documentation, and collateral appraisal.

Are commercial loan interest rates fixed or variable?

Both fixed and variable rates are common. Fixed rates offer stability, while variable rates can fluctuate with market conditions.

Can commercial loans be used for debt consolidation?

Yes, businesses often use commercial loans to refinance or consolidate higher-interest debt.

Does taking a commercial loan affect my business credit?

Yes, repaying a Commercial Loan on time can improve your business credit, while late payments can harm it.